Panoro Energy: 16% Yield, 60% Upside and Strong M&A Read-Through

Major Appraisal News Incoming – Market Not Paying Attention

Panoro Energy (OSE: PEN) is emerging as one of the clearest undervalued dividend plays on Oslo Børs. After years of heavy investment and a fivefold increase in production, the company has transitioned into a cash-generating phase with declining capex, rising free cash flow, and an industry-leading yield.

Yet, it trades at a ~60% discount to NAV.

Key Metrics

Market cap: NOK ~3.2bn (per 01.04.2025)

Net debt (2024): ~USD 50m

Production (Q4’24): 12,000+ boe/d (100% oil)

2025e yield (dividends + buybacks): 15–16%

FCF yield 2025e: ~35% at $75 Brent

NAV (Pareto): NOK 44 → ~61% upside

High Yield, Strong Cash Flow

With high-margin oil production now plateauing at Dussafu and no large development projects on the horizon, Panoro expects to return NOK 500m to shareholders in 2025. That equals a 16% yield, split between dividends and buybacks.

Capex is dropping sharply in 2025, freeing up cash. Both Pareto and SB1M expect free cash flow to exceed enterprise value by 2027, assuming no large acquisitions.

Valuation Disconnect

A recent M&A deal provides a clear benchmark: Tullow sold its Gabon assets (36 mmboe 2P, ~10k bbl/d) to Gabon Oil Company for USD 300m, or ~USD 10/bbl after tax.

Pareto values Dussafu at USD 11.3 per barrel of 2P reserves, based on $70 Brent and a 15% discount rate. In comparison, Tullow recently sold its Gabon portfolio — with similar production and reserves — for a price that implies around USD 10/bbl after tax adjustments. That’s only a 12% discount to Panoro’s valuation, despite Tullow selling a mature, declining asset, while Panoro’s Dussafu just reached plateau in late 2024 — the point at which reserve valuations typically peak.

Applying this Tullow transaction multiple to Panoro’s Dussafu reserves supports a share price of NOK 39, or ~43% above current levels. Pareto notes that the market may even have overpaid for Tullow, suggesting that Panoro could be worth more, not less.

Asset Snapshot

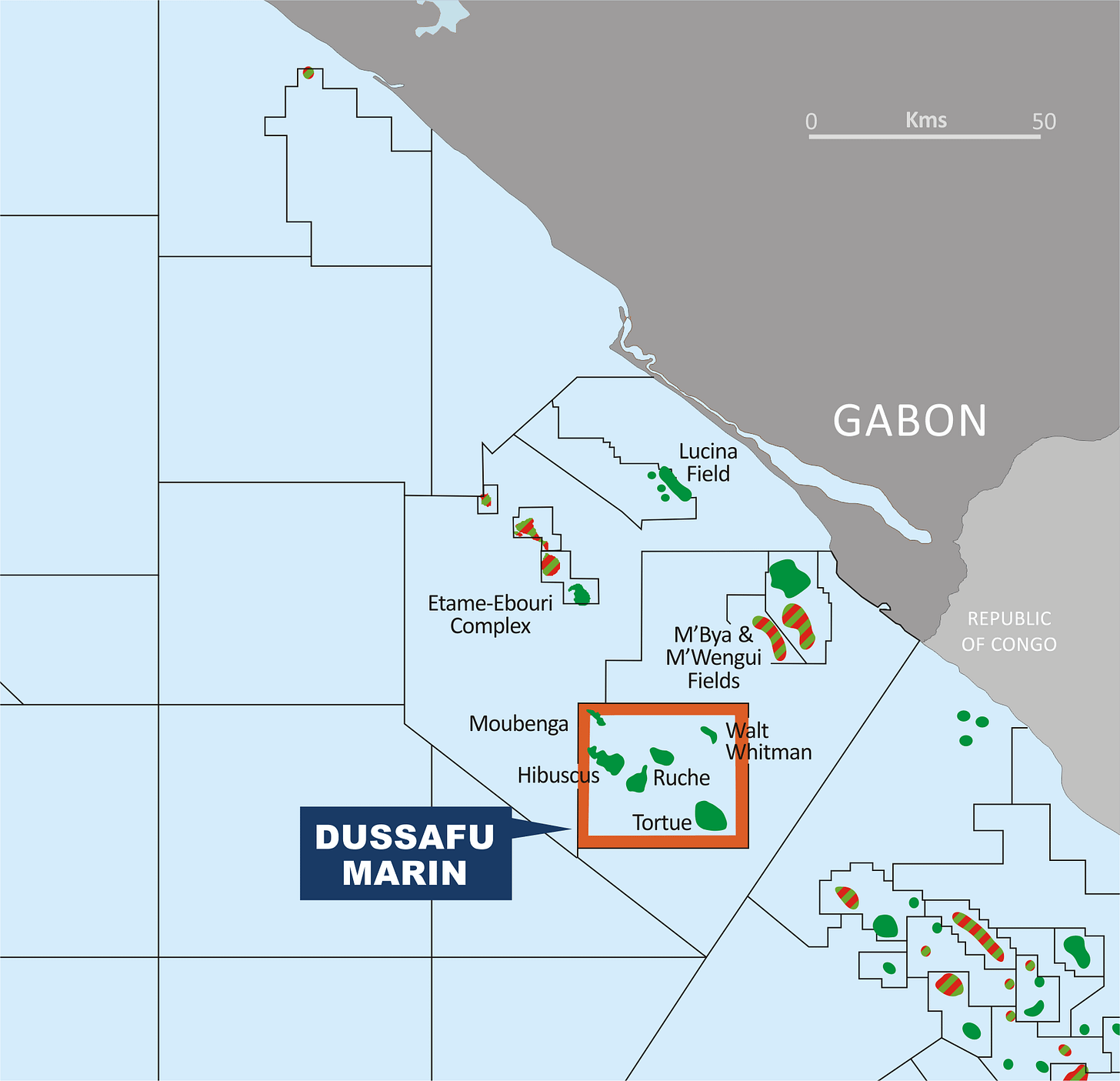

Gabon (Dussafu) – Core Asset

Fully ramped up in Nov ’24

Bourdon discovery being appraised now – results expected within 1–2 weeks

~140 mmboe of prospective resources on license

High historical success rate

Equatorial Guinea

Renewed attention following Conoco’s acquisition of Marathon

Panoro participating in producing Ceiba/Okume fields

Tunisia

Low capex, stable production

No near-term catalysts, but cash generative

Near-Term Triggers

Bourdon appraisal result (expected in 1–2 weeks): may upgrade resources and valuation

Potential TP upgrades from analysts as Bourdon is derisked

Potential dividend hikes in the upcoming quarters due to increasing FCF

Final Take

Panoro offers a rare combo of:

Double-digit yield

High-quality producing assets

Clear undervaluation vs M&A comps

Multiple near-term triggers

Between the 16% payout, the 60% NAV discount, and catalysts just weeks away, Panoro looks like one of the clearest mispricings on Oslo Børs right now.

Disclaimer: This article is for informational and educational purposes only and does not constitute investment advice. Always conduct your own research or consult a financial advisor before making investment decisions. The author may hold positions in the mentioned securities.

Thank you - very informative and I have taken a first nibble 🎢