Nordic Mining: From Permits to Profits

Engebø is nearing steady-state. With offtake deals in place and FCF coming, is the rerating next?

Nordic Mining (NOM.OL) is inching closer to becoming a major industrial minerals producer in Europe. After nearly two decades of exploration, permitting, and financing, the company is now deep into the ramp-up of the Engebø rutile and garnet mine on Norway’s west coast. It’s a high-grade, dual-mineral project with a long mine life, locked-in buyers for the first five years, and compelling cash flow potential. Even so, the company still has to prove it can deliver.

Here’s what investors should know.

The Engebø Mine

The company’s entire valuation is currently tied to the success of the Engebø project. Clarksons values Engebø at a base case of NOK 26/share, suggesting ~23% upside from the current share price of NOK 21.20. Their bull-case valuation is NOK 38, which would represent nearly 80% upside. SpareBank 1 Markets is more cautious, assigning a NOK 23 target, just ~8% above today’s level.

Key value drivers:

First concentrate production achieved in Dec 2024; first shipments of garnet and rutile now expected in Q2 2025.

Offtake agreements covering 100% of production for the first 5 years.

Ramp-up completion targeted by end-2025, with 2026–2030 annual EBITDA expected to average NOK ~600m.

Targeted annual rutile output of ~35,000 tonnes, placing Engebø among the world’s top natural rutile producers

Long mine life: 39 years total (15 open-pit + 24 underground).

Low carbon footprint powered by hydroelectricity.

Strategic Importance to Europe: A Local Source of Critical Minerals

Beyond being a mining project, Engebø plays a key role in strengthening Europe's resource security. Titanium, derived from rutile, is on the EU’s Critical Raw Materials List. As existing European rutile sources like Ukraine are in decline or exposed to geopolitical risk, Nordic Mining’s Engebø mine is positioned to become the only high-grade, industrial-scale source of rutile within Europe.

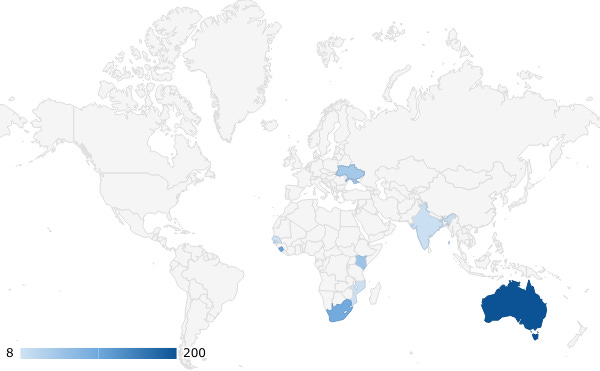

Likewise, garnet – used across advanced manufacturing – is almost entirely imported. Engebø offers Europe its first and only hard-rock garnet source, providing supply chain security and reducing dependence on countries like Australia, India, and China.

Engebø aligns with Europe’s push for secure, responsible sourcing – and could emerge as a model for next-generation mining projects

What’s Driving Demand for Rutile and Garnet?

🔹 Rutile

Primary source of titanium dioxide (TiO₂), used in:

White pigment (paints, plastics, coatings)

Titanium metal (aerospace, defense, medical implants)

Demand is tied to GDP, infrastructure, aerospace, and green energy

Rutile’s high TiO₂ content makes it more efficient and cleaner to process than ilmenite or slag

🔸 Garnet

Used primarily as an industrial abrasive:

Waterjet cutting (47%): precision cutting in aerospace and automotive

Sandblasting (37%): safer alternative to silica sand and slag

Also used in abrasive papers and water filtration

Hard-rock garnet from Engebø is sharper, longer-lasting, and better suited to premium applications than beach-sand alternatives

Garnet demand is expected to grow as regulations tighten in North America and Europe, while rutile is increasingly sought after for both pigment and metal, especially amid rising aerospace and defense spending.

Ramp-Up Friction

Nordic Mining has hit a few bumps during the ramp-up. In March 2025, SpareBank 1 Markets noted that while their models had already priced in a delayed ramp-up, further downward revisions to 2025 production were likely. The company reported that as they scaled up operations in early Q1, mechanical defects and performance issues became visible – particularly in the pump and pipe system. These early-stage inefficiencies impacted throughput and pushed out the expected timing of first shipments.

That said, these types of setbacks are not unusual for greenfield projects moving from construction to production. SpareBank 1 emphasized that investors should focus on 2026 and beyond, when steady-state output is expected, and maintained that the core economics of the Engebø project remain intact. Importantly, the USD 33 million bond tap completed in March 2025 is seen as providing enough financial flexibility to navigate the ramp-up challenges without breaching debt covenants.

Key Risks

Operational Execution: The company still needs to prove it can hit production volumes and quality targets without further delays.

Liquidity: While current liquidity looks adequate, there's little room for slippage. Breaching the bond’s USD 15m minimum cash covenant could trigger refinancing or equity raise scenarios.

FX Exposure: With USD-denominated debt and revenue, but NOK-denominated costs, USD/NOK fluctuations could impact financials.

Financial Snapshot

Market cap: NOK 2.4bn

Capex completed: NOK ~2.75bn

2026E Revenue: NOK 865m

2026E EBITDA: NOK 470m (54% margin)

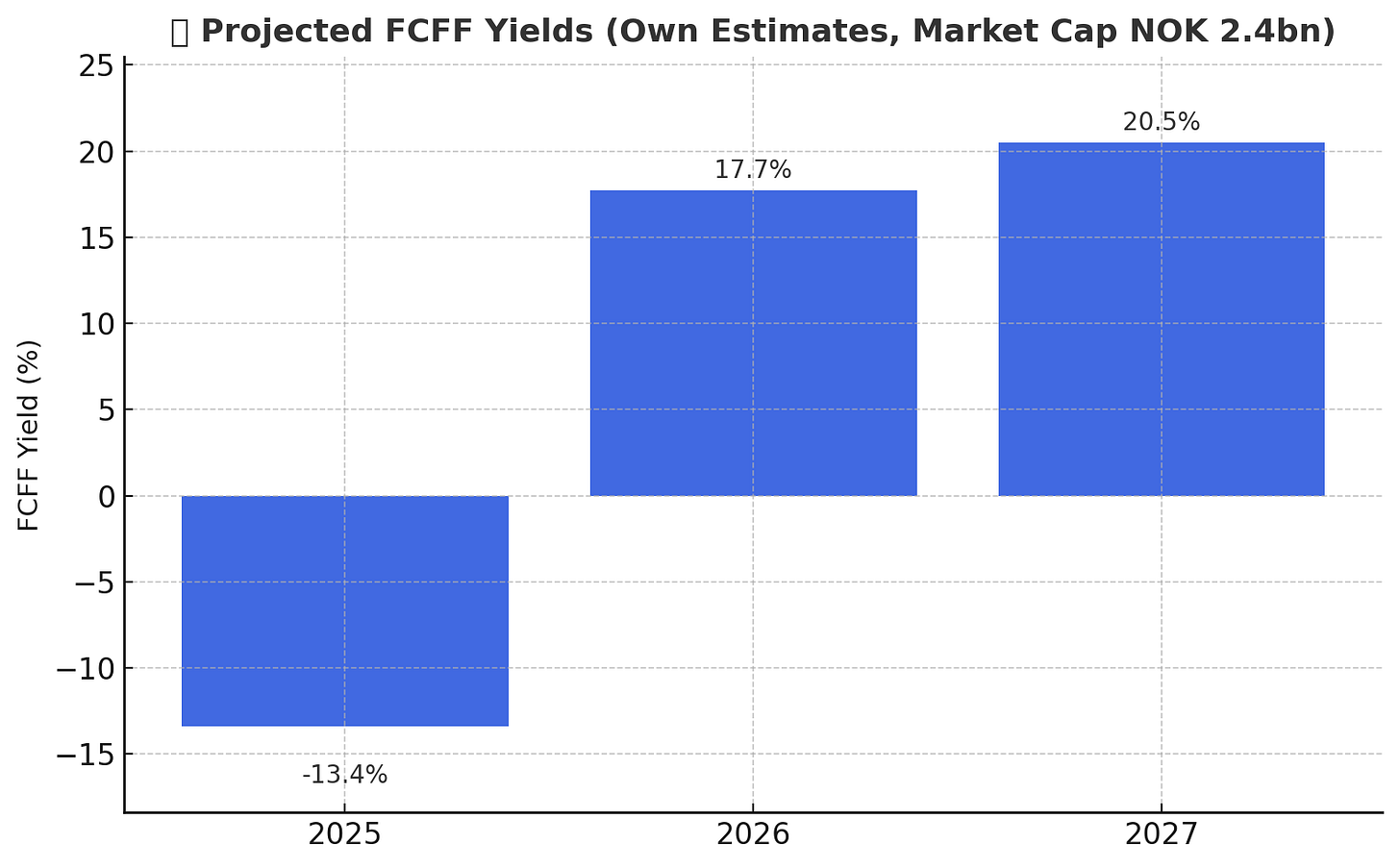

2027E FCFF Yield: 20.5%

Why It Might Be a Buy

If Nordic Mining delivers on its revised ramp-up targets and avoids further hiccups, the market could rerate the stock significantly. EV/EBITDA is expected to compress to ~5x by 2027, reflecting a potential shift from speculative to cash-generative.

Medium to long-term dividend potential and a refinancing of the 12.5% bond provide additional catalysts.

Bottom Line

Nordic Mining is in the final stretch of transforming from developer to producer. The production ramp-up isn't without noise, but with offtake agreements, strong margins, and a strategic resource, the long-term story remains intact.

Risk-tolerant investors with a medium-term horizon may see recent turbulence as a chance to build a position.

Disclaimer: This article is for informational and educational purposes only and does not constitute investment advice. Always conduct your own research or consult a financial advisor before making investment decisions. The author may hold positions in the mentioned securities.